AAR vs. IRR - What’s the Difference?

Two commonly used terms in passive real estate investing are AAR (Average Annualized Return) and IRR (Internal Rate of Return). Both measure the ROI (Return on Investment) of a commercial real estate investment. However, there are several distinctions between the two calculations. As a passive real estate investor, it is important to understand the different terms, what they measure, and how to use them when vetting potential deals.

What is AAR?

The average annualized return, or AAR, is a simple equation used to calculate the average amount of money an investment earns each year. AAR is calculated by taking the total ROI and dividing it by the years of investment.

Mathematically, the equation looks like this:

AAR = Total ROI / # of years of investment

For example, let’s say you invest $100,000 in a syndication, and the total ROI provided to you is $64,000 over four years.

AAR = $64,000 / 4 years = $16,000 average annual return (in dollars). This is a high-level estimate of what you’d earn each year that your money is tied into the multifamily project.

Typically, when being presented with an investment opportunity with a multifamily syndicator, they will give you an AAR as a percentage. For example, you may be looking at investing $100,000 in a deal that is with an estimated 16% annual return. To calculate what that means for you in dollars:

$100,000 * 16% = $16,000/year

But remember, if you are investing for equity growth, you may not actually see that $16,000 in your bank account each year. It is likely that you will get a lump sum payout at the end of the deal lifecycle that adds up to an AAR of $16,000/year, but is paid all at once. See our article here for more on the difference between investing for equity and investing for a preferred return in passive syndication deals.

For reference, at the time of this writing, 14% or higher is generally considered a good AAR for a stabilized property needing light, cosmetic upgrades. Heavier value-add projects should be at 16% or higher and new construction should be above 18% due to the higher risk and lack of cash flow.

While this measurement is used widely in multifamily syndications, I personally do not focus on AAR when evaluating passive investment opportunities. I use IRR, which we will get to next. Here’s why:

Let’s say you’re comparing two properties.

Property A requires a five-year investment with 100% ROI.

Property B requires a 10-year investment with 200% ROI.

Both properties yield a 20% AAR when you do the math (100%/5 and 200%/10), except Property B locks up your money for double the time. AAR does not consider various consequential factors that arise from this longer time horizon, including inflation, time, and opportunity cost. These additional costs could result in significantly lower real returns. Given a choice, of course, you’d choose the 5-year property, which is why it is critical to understand IRR, not just AAR, when vetting deals.

What is IRR?

Internal rate of return still measures the annual return but is a much more complicated equation that offers a deeper dive into the potential returns on an investment. The most notable difference between AAR and IRR is that IRR takes inflation and time of holding into account.

The use of AAR alone is too simplistic, leaving out the reality of today’s dollar value and the longevity of the deal. Using IRR allows investors to truly compare apples to apples. With a more specific return estimate, investors can make more informed decisions.

IRR takes into consideration the level of annual distributions for investors, the date that the property will be sold, and the price that the property is expected to sell for in order to calculate the total projected return. Because IRR takes into account all of these factors that AAR does not, you may actually see that the estimated IRR of a project is lower than the estimated AAR.

The mathematical formula to compute IRR is complex and relies on the same formula as Net Present Value (NPV) does. This is because the IRR is in fact the discount rate that would make the NPV of an investment equal to zero. Trying to manually calculate IRR is complex (we won’t dive into the details here) so we suggest using Excel’s built in formula if you are trying to work out an IRR number.

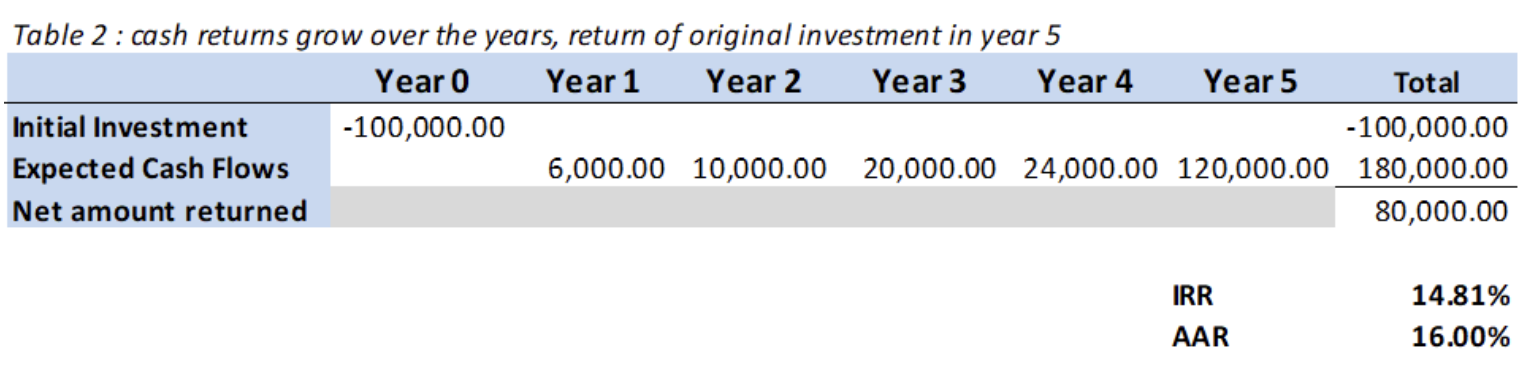

Using the same numbers used in the AAR example above, let’s compare the IRR of the same project with identical cash returns. The only difference between Table 1 and Table 2 below is when the investment returns cash over the 5 years:

This table shows the returns from the investment being evenly distributed over the course of the 5 years, which is why AAR and IRR are the same

This table shows the returns from the investment being distributed in different increments with more being returned in later years. Since IRR takes into account timing, the IRR is now lower than the AAR.

In this second table, the IRR is technically lower than the AAR (14.81% vs 16%) because more of the cash is received in the later years and the IRR calculation takes this into account whereas AAR does not. This is why AAR can be considered misleading if, like in most passive multifamily investments, your cash is not being returned in equal increments over the life of the investment.

So, what is considered a “good” annual IRR?

At the time of this writing, a good IRR for a low stabilized multifamily syndication with cosmetic value-add play would be 13-14%. A healthy IRR for heavier value-add properties would fall around 15%, while new construction should be 16% or higher.

If you’re currently looking at an investment opportunity or have a current investment and want to calculate your IRR, you can use our simple online IRR calculator annual return will look like.

Conclusion

IRR and AAR are two commonly used calculations when it comes to multifamily syndications. Both measure the investor’s estimated return on investment with a few very specific differences. We recommend focusing on IRR, as it offers a more detailed look at the potential profit. When considering potential investment opportunities, be sure to ask for the IRR and be wary of operators who only offer the AAR.

For a deeper dive into the calculations discussed above as well as other common passive investing terminology, check out this article. Remember that whenever you are vetting deals as a passive investor, your syndicator should be able to outline each of these projected numbers before you are ever asked to hand over your hard earned dollars.