What is an Inverted Yield Curve and What Does it Signal for the Economy?

If you’re paying attention to economic news these days, you’ve likely heard the phrases “yield curve,” “inverted yield curve,” and “recession” on repeat. So, what does it all mean? This blog is intended to give you a high-level understanding of what these macroeconomic terms are, how yield curves work, and what signals they provide for our economy.

As investors, we should care about what is happening in the greater macroeconomic scheme of things because these signals tell us what shifts we need to prepare for. Your investing strategy and portfolio should not be the same throughout different cycles. We have to adapt for times of growth and times of recession. Understanding how to read these economic signals will help you get ahead of the curve (literally) and be better prepared to make those adjustments when needed.

What is a yield curve?

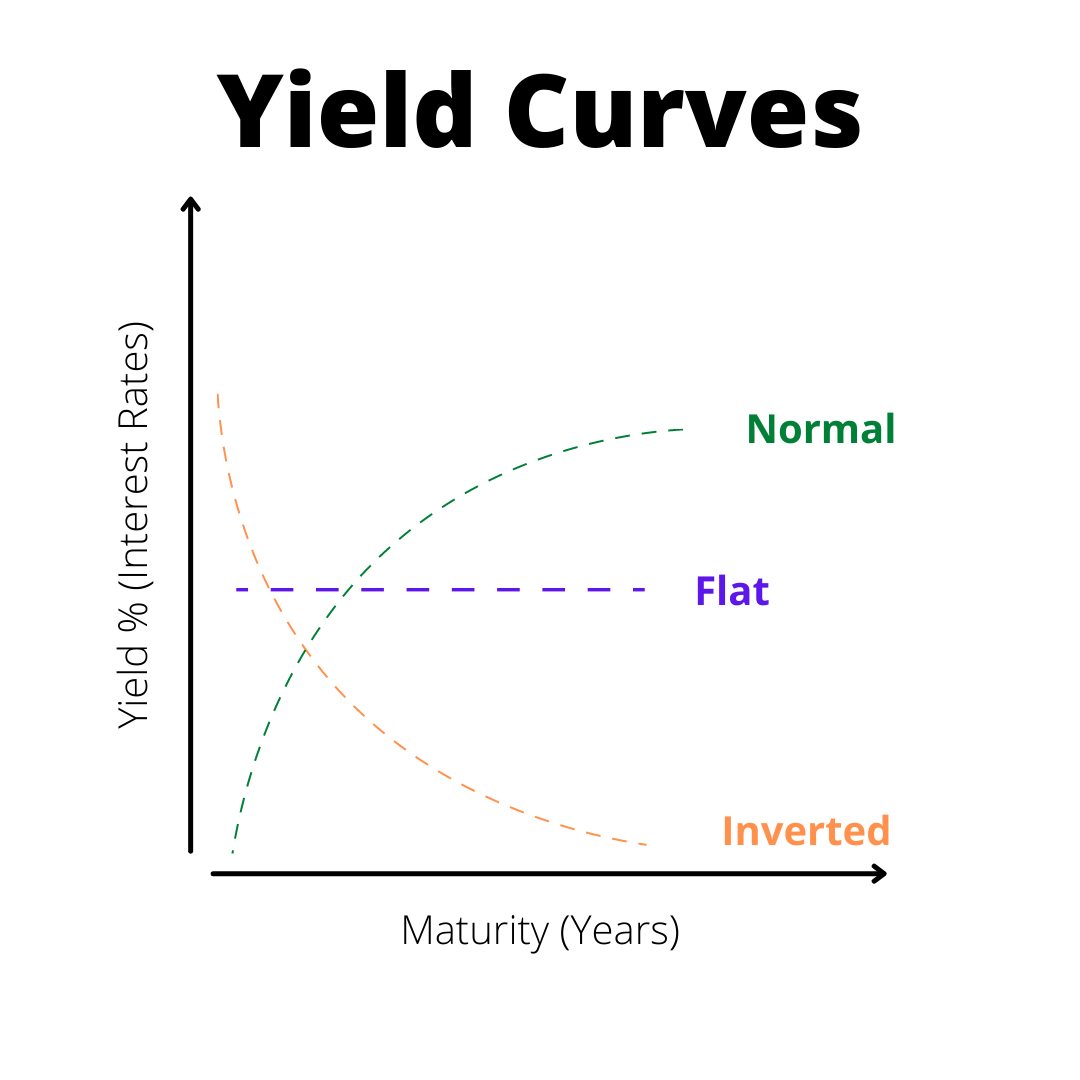

A yield curve is a simple graph that economists and investors use as a benchmark to measure economic activity. It is typically used to plot fixed interest securities like bonds. The “yield,” which is measured on the Y-axis, represents the current interest rates. It tells you how much money your money is making.

The X-axis plots the length of the investment, otherwise known as “maturity.” Maturity indicates the lifespan of the loan or bond and is expressed in years. Typically you would plot the interest rates for differing lengths of maturity, for instance a 2-year, 5-year, and 10-year bond.

The yield curve (the one that everyone is talking about) plots the interest rates and differing maturity dates of U.S. Treasury Bonds. These bonds, also known as T-bonds, are used by investors as a low-risk option to earn money through yield/interest payments. The yield is basically the money paid by the U.S. Government to borrow American dollars for varying lengths of time. Typically, the longer the maturity date, the higher the interest rate.

Three types of yield curves

A yield curve can be described as normal, flat, or inverted. These three different curves not only look different, but they indicate contrasting realities and predictions for the U.S. economy.

A normal yield curve arches upward, demonstrating a healthy economy and investors’ confidence that it will continue to grow. Normal yield curves show short-term interest rates as lower than long-term rates. This makes sense because any investor expects that if they agree to “lock up” their money for a longer period of time, which means they can’t use it for other activities, they should be compensated at a higher rate.

A flat curve shows yield rates similar across the board, indicating that economic growth is expected to be slow. The interest paid on a 2-year bond is about the same as that of a 10-year bond.

An inverted curve looks like a crooked letter “U.” It is the exact opposite of a healthy or normal curve. This inverted curve sounds the alarm for investors, as it is an indicator of an economic recession. Since the Fed began publishing data in 1976, a recession has inevitably followed an inverted curve, 10 times out of 10. An inverted curve means that short-term rates are higher than long-term rates, which defies the logic provided above.

Long-term vs short-term rates

Bonds with longer maturity dates typically have a higher interest rate (or yield) due to the added risk associated with keeping money tied up for 20-30 years. In contrast, short-term bonds pose less risk and, therefore, pay the investor less in interest. In a healthy economy, when these rates and maturity dates are plotted on a graph, you will see a “normal” yield curve.

As the rates change, the curve follows. The yield curve can change in two ways. On the left side, where rates are typically lower, the Fed can control things by slowly raising the rates on short-term bonds (a term known as quantitative tightening). This is usually done as an effort to limit inflation by reigning in the amount of money that is in the economy. If interest rates are higher, people are less likely to borrow money, and therefore, inflation slows down. That is what has been happening in recent months, as short-term rates have been slowly climbing.

The right side of the curve represents longer-term bonds. This side can be influenced by the confidence of investors in the state of the economy. When the economy is healthy, investors tend to pull their money out of long-term bonds and put it into riskier investments. As the demand for long-term bonds decreases, the price decreases as well, pushing the yield up.

On the other hand, when investors are less confident in the future of the economy, they put their money back into long-term bonds.

Stay with me here.

When these two things happen at the same time:

The Fed increases short-term rates WHILE investors are buying more long-term bonds because they are not confident in country’s economic future, the curve begins to flatten.

If the trend continues long enough, the curve will eventually invert, which economists typically refer to as an omen for an economic recession. Remember, the Fed can really only control short term interest rates, not long term interest rates. Long term rates are controlled by the overall market.

What is a yield spread and why should I care?

The yield spread is the difference in yields between 10-year (long term) and 2-year (short term) bonds. When this number dips below zero, that is considered an inverted yield curve. According to Investopedia, “this spread is one of the most reliable leading indicators of a recession.”

Here’s how to read the chart below:

■ When the line in the graph moves in an upward direction, the yield spread (aka the difference between the 10-year and 2-year yield) is growing.

■ When the line moves in a downward direction (aka the difference between the 10-year and 2-year yield), the yield spread is reducing.

■ When the yield spread dips below 0, short-term bond rates are the same or higher than long-term bond rates. You can see from the chart below that the line is starting to head in that downward trajectory towards 0.

A view of the T-Bond yield spread over the last 10 years. Source: https://fred.stlouisfed.org/series/T10Y2Y

Why does it matter when the yield curve is inverted and the spread dips below 0?

Remember, in a normal “healthy” economy, yields should be much higher on long-term bonds than short-term bonds. When the spread goes down towards 0 and is close to negative, it means that the equation is flipped. 10-year bond interest rates are lower than 2-year interest rates.

Why is this happening now? If you’ve listened to the news recently, you’ve heard about the Fed announcing rate hikes this year. That means they are raising interest rates on short-term bonds and that is causing this spread to decrease (as short-term bond rates go up, the spread between short and long-term yields lessens). If it goes too far down, short term rates become higher than long term rates. This is then typically followed by a decrease in economic growth because there is less money in circulation and less investor confidence in the market.

Remember, what goes up, must come down in the way our current economy is structured. Times of growth and times of recessed growth are normal. What’s important is that you are aware of these business cycles, understand where we currently are in the cycle, and what is coming next.

Understanding the U.S. Treasury Bond Yield Curve helps you to make sense of the current economy and offers a little more insight when planning for the future. Keep an eye on the treasury bond rates to understand where the economy is likely headed. As things stand, it looks as though we are on the path to an impending recession. Now is a great time to create a contingency plan, diversify your portfolio, and prepare for how a possible recession might impact your investment portfolio and strategies. We talk more about how to do this in our article about how to prepare for an impending recession. We will continue to deliver valuable information and insight to help you navigate whatever economic changes lie ahead.